The outlook for the domestic steel industry looks bright, since India has good iron ore deposits, skilled man power and growing demand,says Seshagiri Rao , Director,Finance, JSW Steel.

What is the outlook for the global and domestic steel industry ?

The steel industry has undergone a few structural changes in the past 3-4 years. So, the outlook for the next few years is likely to be driven by the kind of consolidation that has taken place in the past few years. The other factor that is likely to affect outlook is the extent of demand emerging from BRIC countries.

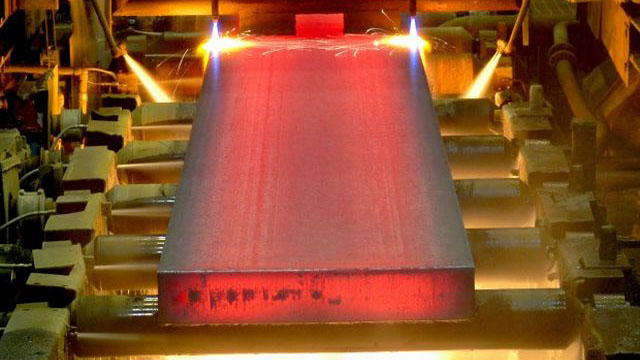

In addition to these two major factors, a cost-push is coming from raw material suppliers. Hence, steel manufacturers have to contend with strong demand on one hand, and cost-push on the other. The outlook for the domestic industry looks bright, since India has good iron ore deposits, skilled manpower and growing demand for steel.

There is an apprehension that if China slows down, it may dump its surplus steel into India. Do you think this can be a distinct possibility? An analysis of global data shows that even if an economy slows down, steel consumption does not fall dramatically.

In the case of China, a slowdown can mean that the growth rate may fall from 19-20% to a lower level. But that doesn’t mean growth will not take place. China produced around 470 million tonnes (mt) of steel last year, out of which, 66 mt was exported and the rest was consumed within the country. The measures undertaken by the Chinese government recently will reduce exports significantly in the current year. There is also a change in the consumption pattern. For instance, if construction activity slows down, the consumption of white goods will pick up and demand for flat steel products will go up.

The new capacities coming up in China are on the flat products side and not on the long products side. Overall, the impact on the supply side will be less. Similarly, the cost of production is very high — it costs around $500 per tonne to produce more than 100 mt of steel in China. Since the cost of production is very high and exports are not allowed, many of these plants will be closed down by ’09-10.This will reduce the supply of steel.

There’s a feeling that India doesn’t have much iron ore, considering the recent capacity expansion plans of domestic and foreign steel companies in India.

There is a possibility that if we continue exporting iron ore, we may run out of reserves. Currently, we export 90-100 mt every year and this is steadily increasing. Ideally, we should increase our steel production capacity — we are a net importer of steel — so that rather than exporting iron ore, we can add value to it. We should also look at investing in exploring new mines.